One of the things I cover at Travel Tactics is credit cards, since they are good tools for earning points and miles. Today Apple announced Apple Card, its own entrance into the rewards credit card market.

Here’s a look at what Apple announced and what people can expect from this service.

Apple Card is built into the Apple Wallet app, but it isn’t the company’s first payment processing venture. Just a few short years ago, Apple Pay came onto the scene featuring secure payments with just an iPhone or Apple Watch.

Now Apple is choosing to expand the Apple Pay system further, with its own tangible credit card. But this card, however, is a bit different.

Apple Card: A new kind of card

It’s a card and software duo that provides extra layers of security and allows unique tracking of purchases on Apple devices. Let’s take a look at what that means.

Apple says its card is a new kind of credit card, created by Apple, and not a bank. Here’s how they describe it:

Apple Card completely rethinks everything about the credit card. It represents all the things Apple stands for. Like simplicity, transparency, and privacy. It builds on the incredible ease and security that millions of people love about Apple Pay. And it’s the first card that actually encourages you to pay less interest. You can buy things effortlessly, with just your iPhone. Or use the Apple‑designed titanium card anywhere in the world.

Apple emphasizes privacy in its products and services, and this one is no different. Paired with transparency and ease of use, privacy is one of the credit card’s key features.

Also, you read the last part of the description right. The Apple Card will be made out of titanium. Of course, that doesn’t mean anything when it comes to spending power or making purchases, but I think it’s interesting at least. Especially since many credit card issuers have been jumping on the metal card bandwagon over the past few years.

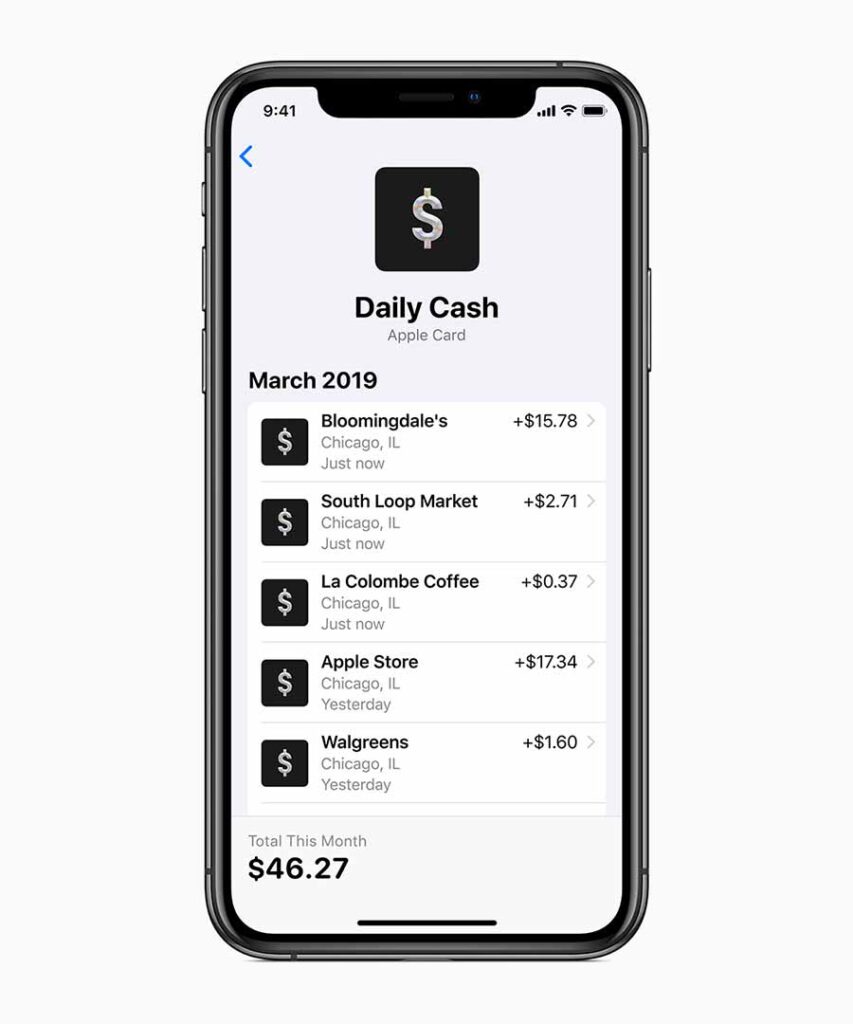

Daily Cash

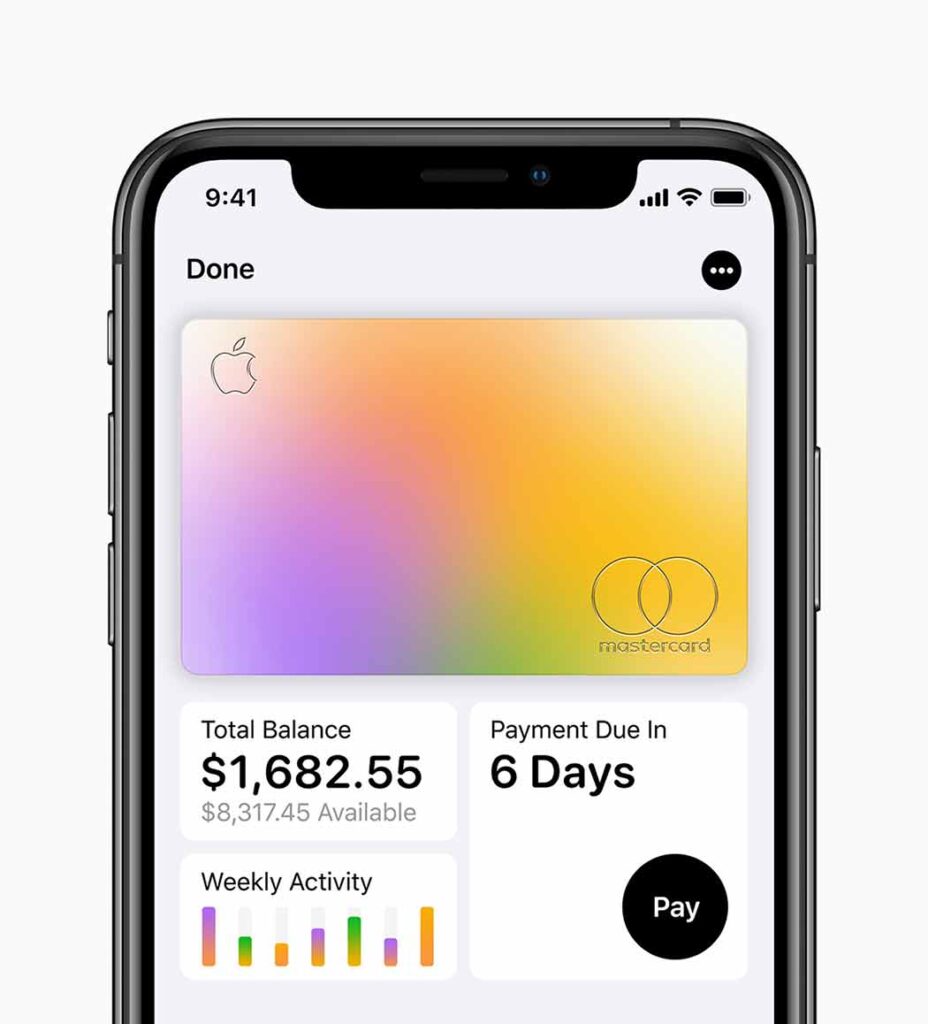

Beyond the physical card itself, Apple says it is a cash-back credit card with a tiered reward system. It’s called Daily Cash. Here’s how it works. Apple Card earns 3% back on Apple and iTunes purchases, 2% back on all Apple Pay purchases, and 1% back at stores, websites, or apps that do not accept Apple Pay.

Daily Cash earned goes straight to a user’s Apple Cash card. From there it can be used to make purchases, pay back a friend in Messages, make a payment on Apple Card, or even sent to a bank account.

But unlike other rewards credit cards, Daily Cash is available nearly “immediately.” This is in stark contrast to other reward programs that only post earnings when the current statement closes. Some post even later.

As usual, money on an Apple Cash card can be spent using an iPhone, iPad, Apple Watch, and Mac.

Fees

Many cash-back credit cards do not have annual fees, but Apple takes this experience and builds upon it. In addition to no annual fees, the card boasts no cash-advance fees, no over-the-limit fees, and no late fees. Now that’s a serious lack of fees.

But don’t forget that this is a credit card, and does incur interest for carried balances. Apple says its goal is to provide interest rates that are among some of the lowest in the industry.

Speaking of interest, one of the features of the card is an interest tracker, allowing a user to see exactly how much interest they would pay over a given amount of time.

While this kind of tracking isn’t new to the credit card industry, it is certainly a welcome one in the interest of consumers.

Security

One of the more interesting parts of the physical Apple Card is what it doesn’t have. There are no numbers on the card, no CVV, no expiration date, and no signature.

According to Apple, when someone first gets an Apple Card, a unique device number is created on the user’s iPhone. Then it’s locked away in the “Secure Element,” which is Apple’s proprietary chip in iOS devices that securely stores sensitive information.

Additionally, Apple notes that every purchase requires your device number along with a one-time, dynamic security code that iPhone generates when you authorize the purchase. Authorizing is done by Face ID or Touch ID.

Payment processing

Apple is partnering with Goldman Sachs and Mastercard to provide the support of an issuing bank and global payments network. Further, Goldman Sachs has agreed to never share or sell data to third parties for marketing and advertising.

Apple said it will launch Apple Card for the US in summer 2019.

Finally, Apple says keeping track of spending and payments will be extra precise and simpler when using it. Each purchase is automatically categorized in the app, allowing users to track spending at a glance.

Beyond categories, each Apple Card purchase is mapped with a unique GPS locator. This helps take the guessing out of looking through line items in a statement.

My take

For me, it all looks very nice – and who doesn’t appreciate more purchasing protections? I use Apple Pay here and there, usually for coffee and small purchases.

One thing is for sure. Apple left no question that this is a cash-back card. The website says, “No points. No gimmicks.”

As someone who works to maximize points and miles through usual everyday spending, I see my strongest return with card issuers like Chase and American Express. Using cards like this and stacking them with online shopping portals is a solid way to exceed 2% and 3% back.

That’s not to say cash-back cards don’t hold value- they certainly do. It’s just those like me who seek travel rewards have options that should be weighed.

What do you make of the new Apple Card? Share your thoughts in the comments.

Featured image courtesy of Apple.